Contributed by Todd San Jule

What a weekend it was to be a sports fan. If you were lucky enough to attend the Super Bowl in Los Angeles or the Waste Management Phoenix Open, you not only witnessed some historic moments (10 years from now I am not sure what I will remember more - the epic Super Bowl Halftime Show or the “rain delays” on the 16th green at TPC Scottsdale), you also most likely used the latest and greatest mobile technology at the event. This might have been for ticketing, ordering another of your favorite beverages, wayfinding, or replaying over and over Sam Ryder's incredible hole in one.

As a technology partner that was involved in supporting these major events this past weekend, Venuetize knows all about what it takes to deliver an amazing fan experience on the biggest stages. Our tech has been deployed across all the US major professional sports leagues, as well as professional golf and major tennis tournaments, concerts, and other special events. Although there is no magic formula for delivering a frictionless event, there are several must haves to ensure your FAN has a FAN-TASTIC experience.

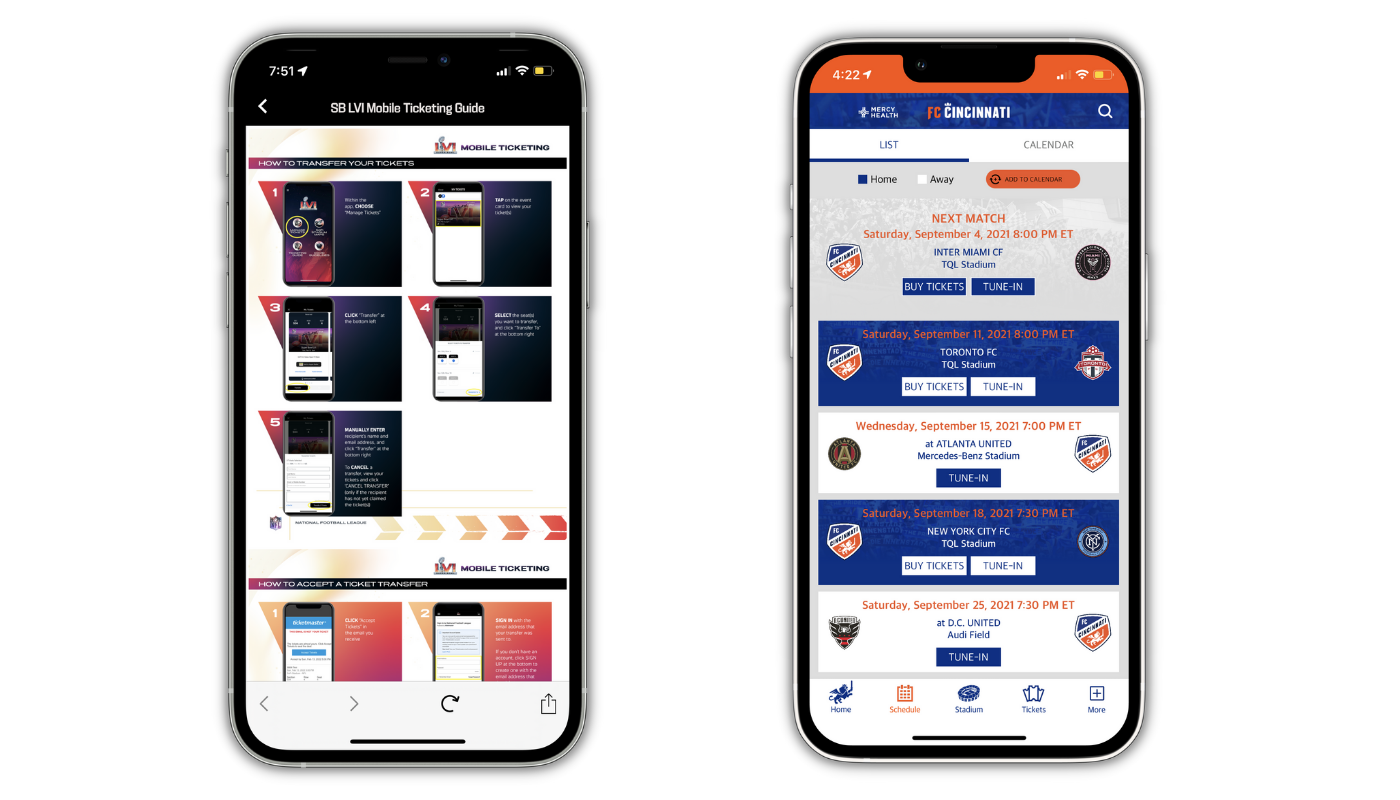

Easy Entry

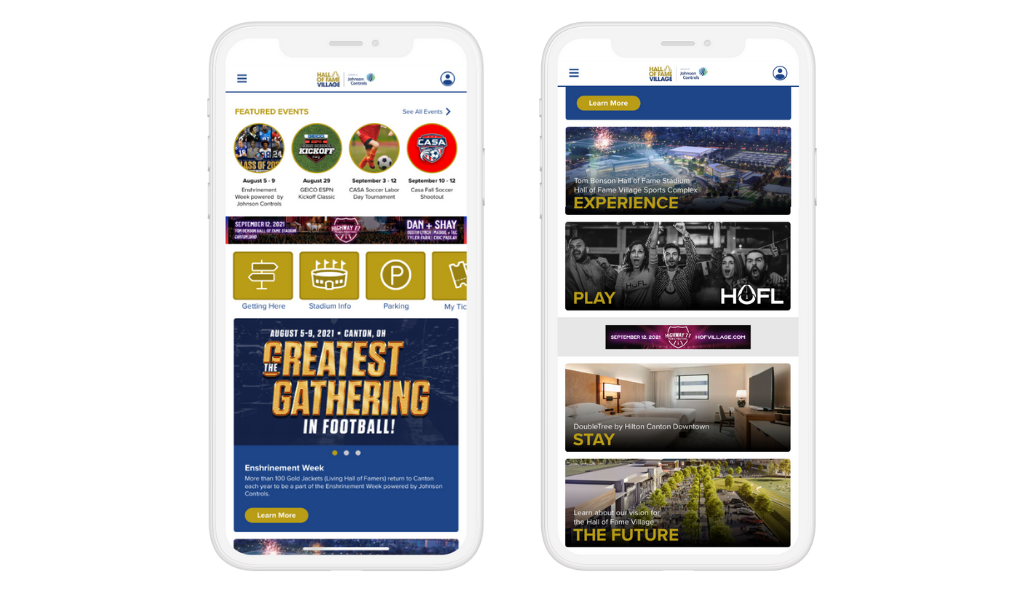

Tickets have gone digital. Especially since the pandemic, most sports fans are now accustomed to using their mobile phone to enter a stadium or venue. This might be by accessing their ticket through a team or venue app, or logging into a ticketing web site such as Ticketmaster, or loading their ticket into Apple Wallet or Google Pay app. However, as with any technology, things can go wrong. At a recent professional sports event I attended, one frustrated fan after another was turned away at the Gate and sent to Customer Service because they could not access or download their mobile ticket. Key takeaway: By providing ticketing integration into your mobile app (without requiring fans to remember another web site or another password), your fans will experience fewer delays entering the venue.

High Speed Wi-Fi

According to our friends at The Sports Innovation Lab, Americans check their phones an average of 96+ times per day. You might think this number would go down at a sports event, but it's actually the opposite. Whether it's looking at stats, checking other scores, making a bet, or posting to social media, sports fans are glued to their mobile device. That is, only if there is high speed Wi-Fi available. I recently attended an outdoor professional sporting event, and because of spotty Wi-Fi service I was not able to access live scores or player stats, let alone try to live stream the event. Key takeaway: The mobile phone is your friend, not your competition for eyeballs. Invest in high-speed Wi-Fi and enable your fans to use their mobile phone as a second screen viewing device. Your customer satisfaction, attendance, and profitability scores will all be positively impacted as a result.

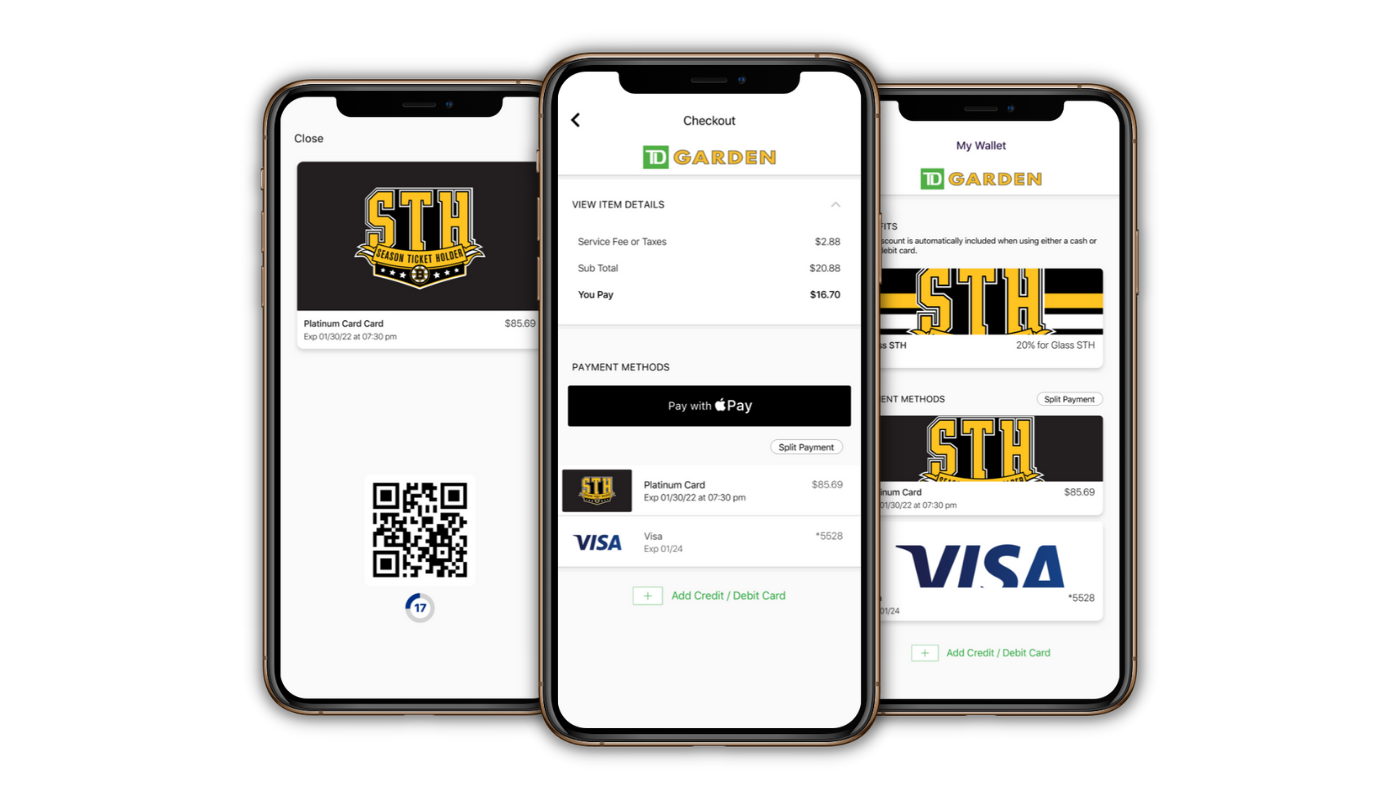

Quit the Queuing

Everybody hates waiting in lines. Especially when it means potentially missing the big play or the big putt. That's why teams and venues have been investing in new technology to make it quicker for fans to get a bite/drink and get back to their seats. A number of our clients are leveraging Venuetize's Mobile Ordering and Mobile Wallet products to enable fans to order food and beverages for pickup or in-seat delivery. Other clients are installing touchless checkout systems that allow fans to truly grab and go - with no barcodes, no cash, and no wait. At a recent sporting event, I was able to skip a 30-minute line and get my favorite mixed cocktail automatically poured from a company called Tended Bar. I took a photo, showed my ID, scanned my credit card, and 2 minutes later I was sipping a Moscow Mule while my buddy had not moved an inch in the normal line. Key takeaway: From Uber Eats to DoorDash to Instacart to Amazon Go, Americans young and old have become accustomed to using their mobile phone and other technology to order and pick up food. Don’t let operational fears or gadget overload get in the way of investing in new tech. Win your fans over by losing the lines.

Interested in learning more about Venuetize’s platform and in-venue technology? Contact us and set up an appointment today!