Contributed by Myles Romm

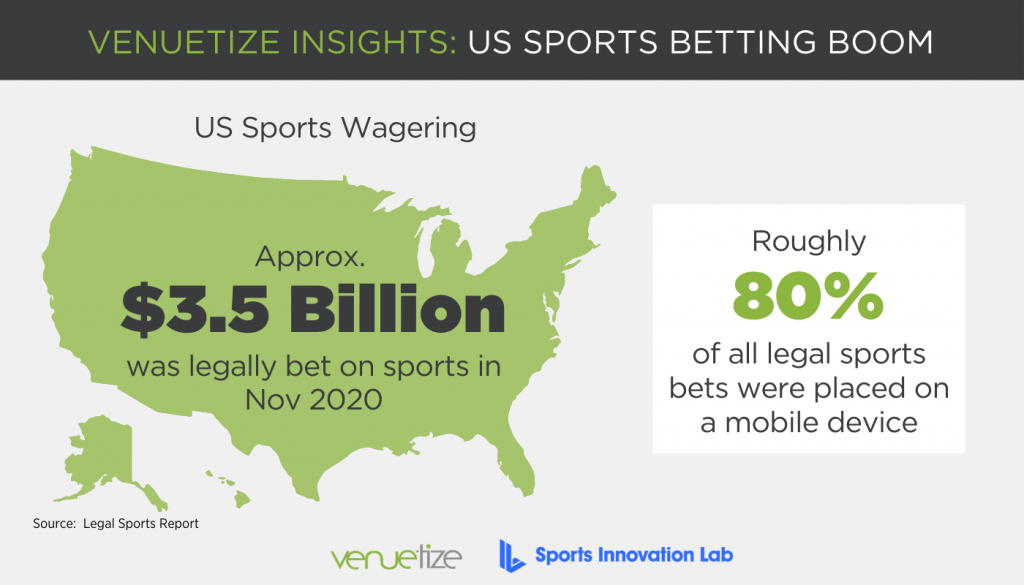

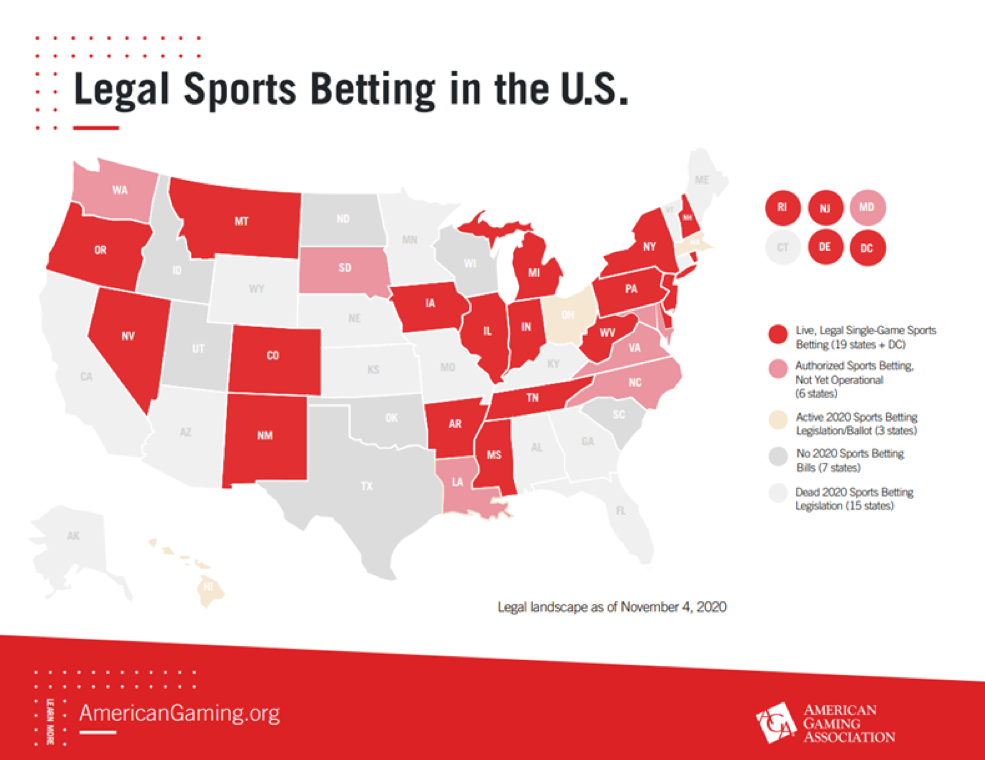

We are in the middle of a contemporary gold rush that spans from coast to coast. Sports betting has exploded across America as more states vote to legalize the practice in fear of missing out on a potential billion-dollar revenue stream. As it sits currently, 31 states have legalized single-game sports betting, which makes up for 56% of the U.S. population. Another 9 states have betting bills pending.[i] This dramatic change in state policies has been driven by both sports fans’ rapid appetite for sports betting and politicians’ desires to generate revenue for the state through taxes and licensing fees.

The demand for sports betting has been apparent in Michigan, where sports betting took effect in January of 2021 and has accounted for an astonishing $1.5 billion in total sports bets to date. Out of that number, the state-authorized sportsbooks have racked in a healthy $125 million in revenue. And, out of that number, the state has made $5 million off taxes from sportsbook operators.[ii] Mind you, this practice has only been live for 6 months. Eilers & Krejcik Gaming, a research and consulting firm focused on sports betting, estimated that total sports betting revenue in the U.S. in 2021 will reach $1.24B marking a staggering 360% Y/Y growth.[iii] Even more, the company forecasts “revenue of $19.0B if all 50 states legalize sports betting.”

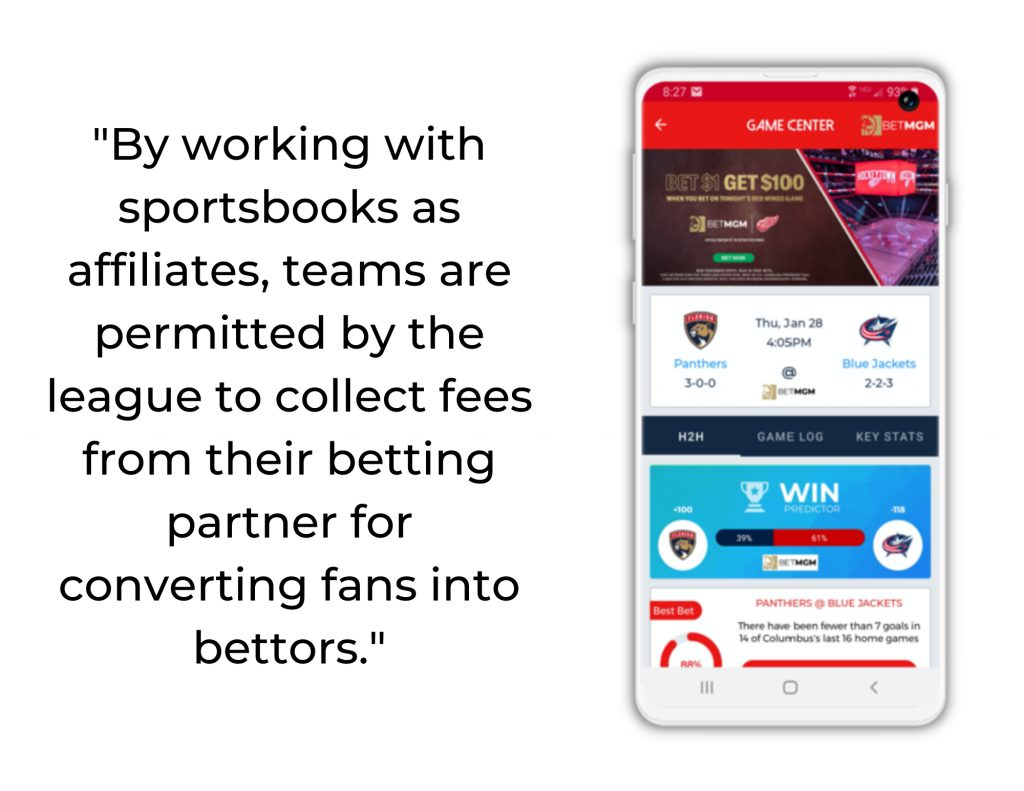

As states continue to legalize sports betting, professional sports leagues and teams have been forced to grasp with how to play in the space. Many teams have signed sponsorship deals with sportsbook operators, generating well-needed income and providing sportsbooks with access to potential new customers. However, there may be an even larger monetary opportunity for teams as an affiliate. By working with sportsbooks as affiliates, teams are permitted by the league to collect fees from their betting partner for converting fans into bettors. As Sportico reports, "all five of the major U.S. sports leagues permit clubs to collect affiliate revenue (some were vague in terms of limitations). Few organizations are believed to be taking advantage of the opportunity.”[iv] Those teams that choose not to engage in affiliate-type partnerships with sport book operators could be leaving a large sum of cash on the table. Some teams, however, are starting to figure out just how lucrative a betting affiliate can be for their organization. Teams like the Jets and the Ravens have hired a sports data company to help assist in brokering sponsorship and affiliate deals with betting partners in New York and Baltimore.[v]

Venuetize Adds BettorLogic to Sports Betting Module

Venuetize has started to work with our clients to find opportunities to monetize betting within their stadiums. Recently, we completed two deals with industry leaders TriggyBet and Bettorlogic to integrate their content into our mobile technology platform. TriggyBet and Bettorlogic operate as the buffer between the fan and sportsbook operators. They act as educators, offering content that is easily digestible and understood by the novice bettor. Through Bettorlogic’s advanced sports betting products, which were deployed by Venuetize in The District Detroit (TDD) app in 2021, Red Wings fans were able to get historical data and recommended bets with one-click access to BetMGM, one of TDD’s sponsors.

By adding an educational component, fans enjoy an interactive and fun betting experience rather than a confusing one. This functionality is crucial in securing a favorable conversion rate of fans to new bettors. Additionally, these integrations service the desire for a more interactive and engaging fan experience instead of just simply watching a live event. People want to be part of the event. Now, as part of the Venuetize platform, teams can reap the financial benefits of affiliated partnerships with sport book operators while offering fans a more engaging experience at their venue.

“Venuetize is an important strategic partner as we look to approach the emerging sports betting market in North America,” said BettorLogic’s CEO, Andrew Dagnall. “Expanding beyond the European betting market as a trusted and proven betting solution, we hope to offer American bettors a similar experience and one that prioritizes convenience and fan engagement. The European betting market is relatively more mature than that of the American market, which requires an aspect of education to ultimately lead individuals to become familiar and interested in betting as a practice. We couldn't be more excited to start collaborating with Venuetize and their clients across the professional sports leagues."

[i] https://seekingalpha.com/news/3707001-sports-betting-revenue-forecast-to-skyrocket-as-more-states-approve

[ii] https://www.playmichigan.com/sports-betting/revenue/

[iii] https://seekingalpha.com/news/3707001-sports-betting-revenue-forecast-to-skyrocket-as-more-states-approve

[iv] https://www.sportico.com/leagues/football/2021/nfl-sports-betting-affiliate-1234631511/

[v] https://www.sportico.com/leagues/football/2021/nfl-sports-betting-affiliate-1234631511/